domingo, dezembro 31, 2006

Stocks of the Year

During 2006, the best performances in precious metal stocks - among a selected but large group I am following - are:

1. Blue chips

Agnico-Eagle Mines (AEM), with an astonishing jump from less than 20 to 41.24. Key explanation: strong earnings from LaRonde Mine in Quebec, Canada´s largest gold deposit in terms of reserves.

2. Junior miners

Tara Gold (TRGD), with a thrilling walk from 0.05 all the way to 1.32! Key explanation: New discoveries and project development.

Happy New Year!

quarta-feira, dezembro 27, 2006

Will Copper hold?

Click chart to enlarge

Chart courtesy of http://stockcharts.com

Copper is very important. After a couple of huge mountains drawn by RSI indicator, we may observe a unique setup of the significant weekly EMA65.

Take also a look to the disproportion of levels between the two moving averages shown in the chart.

sábado, dezembro 09, 2006

Osisko once again

Charts courtesy of http://stockcharts.com

What a shoot up since August 2004 when the price was just C$0.24!

It is the result of late discoveries in the Canadian Malartic gold deposit, a very promising property 100% owned by the company. Inferred resource is estimated to be around 6.5 million ounces of gold.

Presently, Osisko has only 65,6 million fully diluted shares.

Examine these interesting two years and six months charts.

segunda-feira, novembro 27, 2006

USD by itself

Click chart to enlarge

Click chart to enlargeChart courtesy of http://stockcharts.com

Let´s see what will happen and what kind of reaction we may observe on Gold.

sexta-feira, novembro 24, 2006

More Charts

Trying to make this blog more useful, I have displayed more graphics of metal prices and related indicators updated every minute. Now you may follow from here the intraday prices of Gold, Silver, Platinum, Palladium, HUI, USD Index, Copper, Zinc, Nickel and Aluminum.

My goal is to show everything that matters. Thank you for coming here!

domingo, novembro 19, 2006

Tara Gold Resources

Tara Gold (TRGD) is a growth-oriented precious metals exploration and development company by re-initiating and increasing production levels at La Currita, Lluvia de Oro and Picacho, and developing the San Miguel, La Millionaria, Pilar De Mocoribo and Las Minitas projects in Mexico.

Last week the company bought Don Ramon and Lourdes mineral concessions near Pilar De Mocoribo. Preliminary evaluation indicates that the property lies within a larger area that hosts numerous and very-high grade Pb-Zn-Ag Carbonate (Limestone) hosted deposits.

Tara Gold has initiated La Millonaria Production Plant, which contain an estimated 30,000 tonnes grading of 9.702 g/t gold and 23 g/t silver.

This junior miner is well in action and has very good potential not only on precious metals but also on base metals.

sexta-feira, novembro 10, 2006

Let´s go!

Click chart to enlarge

Click chart to enlargeChart courtesy of http://stockcharts.com

But they were not alone as Agnico (AEM), Harmony (HMY), Silver Wheaton (SLW), Abcourt (ABI.V), Ivanhoe (IVN), Gold Reserve (GRZ), Miramar (MNG), Eurozinc (EZM), Yamana (AUY), Aurelian (ARU.V), among others, had rallied for the last four weeks.

terça-feira, novembro 07, 2006

Kinross merges with Bema

If Toronto’s Kinross Gold (NYSE:KGC) succeeds in its all-share $3.1 billion merger with fellow Canadian Bema Gold, Kinross will move up in the senior ranks of gold producers.

Each Bema common share would be exchanged for 0.441 of a Kinross common share, representing a 34% premium. After the transaction is completed, 61% of new Kinross would be held by Kinross shareholders and 39% by Bema shareholders. If the transaction fails, Bema (NYSE:BGO) would pay Kinross a $Cdn$79 million break fee.

Analysts were not enthusiastic about the prospect of Kinross taking on Bema’s ownership of the Cerro Casale project in Chile. While Cerro Casale is estimated to contain proven and probable resources of 23 million ounces of gold and 6 billion pounds of copper, analyst Mark Smith of Dundee Securities declared “the project’s awfully expensive,” requiring an initial capex of $2 billion. Both Placer Dome and Barrick have decided against developing the project.

sábado, novembro 04, 2006

Northern Dynasty Minerals

Click chart to enlarge

Click chart to enlargeChart courtesy of http://stockcharts.com

Northern Dynasty (NAK) is advancing the Pebble Project, located in southwestern Alaska, USA, that hosts a world class gold-copper- molybdenum deposit, comprising 22,582 hectares.

The estimated mineral resources in the Pebble East and West deposits are of 54.8 million ounces of gold, 44.7 billion pounds of copper and 2.7 billion pounds of molybdenum.

There is excellent potential to establish significant additional resources with further drilling. Northern Dynasty is now establishing programs in order to integrate this exceptional discovery into an overall mine plan that is optimal for the project.

This an extraordinary project, located on American soil and the company is assessing the merits of building a consortium to permit, finance, construct and operate a modern and long life mine with very substantial annual metal output.

This is the biggest gold discovery ever in North America and majors are already on the race to take over. The first step was already taken last June when Rio Tinto affiliate Kennecott Canada Exploration acquired 9.9% interest in the company.

domingo, outubro 29, 2006

Base metals supercycle remains intact

The recent strength of base metal prices has confounded the sceptics. Lead, zinc and nickel have all hit all record levels while tin has surged to its highest level since 1989. Such gains have defied the forecasts of many investors who believed that the peak in the cycle for metal prices had passed.

US oil prices have declined by a quarter since early August but base metals have largely resisted crude’s gravitational influence, displaying unexpected price resilience in the face of a US economic slowdown and concerns about its impact on global demand growth.

sábado, outubro 28, 2006

NovaGold says no to Barrick

Barrick Gold raised its all-cash bid for Vancouver junior NovaGold by 10.3% to $16 per share Tuesday. The offer values NovaGold at $1.7 billion on a fully diluted basis.

NovaGold has three major assets, including the Donlin Creek project in Alaska in which Barrick is the joint venture partner, with gold resources estimated at 14.8 million ounces, and 100% interest in the Galore Creek project in British Columbia, estimated to have measured and indicated resources of 6 million ounces of gold, 75 million ounces of silver, and 6.8 billion pounds of copper.

However, NovaGold urged its shareholders to take no action at this time. In a news release issued Tuesday, the company said it has achieved “a series of major development milestones on its projects".

quinta-feira, outubro 26, 2006

Our stocks

domingo, outubro 22, 2006

Gold

Chart courtesy of http://stockcharts.com

The most important thing about Gold and its very long term bull run is sustainability. That is exactly what we are founding here with the detail of being EMA50 that is giving a perfect support. Don´t get it wrong, this is a weekly chart and prices are consolidating to go higher.

Silver

Chart courtesy of http://stockcharts.com

That´s a solid a picture that make us believe we may start a rally anytime soon.

sábado, outubro 21, 2006

Copper

A fine (and symmetrical) consolidation. If it follows 2004/05 we have to wait sometime for a new rally…

Yields

Click chart to enlarge

Click chart to enlargeChart courtesy of http://stockcharts.com

Time for consolidation. Bond investors believed that a significant slowdown was on the cards but now they are not so sure.

sexta-feira, outubro 20, 2006

Crude Oil

Since August, Crude Oil has been falling sharply. It seems we have to wait a little more to see a bottom.

Dow/Gold

Yesterday, the Dow edged above the 12,000 milestone for the first time. Considering the magnitude of the past bear market, it is a great achievement indeed. For some further perspective into the current rally, today's chart presents the Dow divided by the price of one ounce of gold. This results in what is referred to as the Dow / Gold ratio or the cost of the Dow in ounces of gold. For example, it currently takes 20.1 ounces of gold to “buy the Dow”. This is considerably less that the 44.8 ounces back in the year 1999. When priced in gold, the current stock market rally hasn't amounted to much. In fact, the longer-term trend is actually down!

"In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value." - Alan Greenspan

quinta-feira, outubro 19, 2006

AURELIAN RESOURCES

Click chart to enlarge

Click chart to enlargeChart courtesy of http://stockcharts.com

Aurelian Resources (ARU.V) is called a junior miner because it is only on an early developing stage of its gold project and not yet near production.

But ARU has a super first class mining property registering reserves of 8 million ounces of gold with 80% of targets yet to be explored!

It is surely a highly profitable investment even at these levels. I will write a more detailed post about this company in the near future.

quarta-feira, outubro 18, 2006

IVANHOE MINES

Click chart to enlarge

Click chart to enlargeExtraordinary junior miner companies never disappoint. IVANHOE got a partnership deal with Rio Tinto and is up more than 30%.

Early on this blog I have expressed my opinion that the price of this stock could rally, with the possibility of going even higher than today´s level.

Nevertheless, I advise you to be cautious and trade a portion at your will, having a stop and following the action.

terça-feira, outubro 17, 2006

Gold and Oil again

Gold is loosing the battle with its EMA 50, which should be expected to happen this month and is looking the horizon from below. There is in place an unpleasant succession of lower highs and lower lows. A descending trend line, for now far enough from 540.

Is it possible that Gold will be trading downwards or sideways till the end of the year? Not likely.

On the other hand, with a few exceptions, every year over the last 15, Crude Oil has found its second half bottom in November or December. There is surely something here to think about.

Is it possible that Oil has already reached a bottom last week? I don´t think so.

After United States elections, we must assess these issues once more.

segunda-feira, outubro 16, 2006

Our stocks

Dear Gold Portfolio

The trend is your friend...

Buy 300 Minefinders Corp (MFN) at 9.35

Buy 500 Northern Dynasty Minerals (NDM.V) at 7.50

Buy 1.000 Western Goldfields (WGDF) at 1.70

Buy 1.000 Stratagold Corp (SGV.TO) at 1.22

domingo, outubro 15, 2006

Minefinders Corp

Click chart to enlarge

Click chart to enlarge Minefinders Inc (AMEX: MFN) has precious metal properties in Mexico and the United States, having valuable and expanding resources at its main project, Dolores, at the Sate of Chihuahua, Mexico.

An independent feasibility study made a positive recommendation of its Dolores property, which is in a developing stage as an open pit. Global capital expenditure is estimated to be approximately USD 132 million. Total cash cost of gold and gold-equivalent silver are estimated to average $238 through the 15.5 year mine life.

The study estimates total production of 1.45 million ounces of gold and 53.2 million ounces of silver (or a total of 2.3 million ozs of gold-equivalent). The project economics indicate a pay back of capital in 3.3 years, a net present value of $277 million and an internal rate of return of 24.3% using $475 and $7.50 as the price per ounce of gold and silver.

It has to be noted that new drilling results (not included in the feasibility study) have increased total project reserves to 2.45 million ozs of gold and 128 million ozs of silver (total of 4.48 million ozs gold-equivalent) and subsequent resource expansion drilling program is underway below the proposed pit.

Infrastructure development at the project has been underway since Q3 2005, construction has already started and production is expected to begin in 2007.

In addition to the resources already drilled, Minefinders Corp controls a strong portfolio of properties in Nevada, Arizona, and Mexico which have the potential to host new multi-million ounce discoveries over the next few years.

With 51.4 million shares fully diluted, Minefinders Corp has a potential stock price well above current prices on a medium/long term basis.

sexta-feira, outubro 13, 2006

ECU Silver Mining

Click chart to enlarge

Click chart to enlargeChart courtesy of http://stockcharts.com

ECU Silver's operations are located on the Velardeña mining property in the state of Durango, Mexico. As a sort of financial back up and having also a role as a developing pilot plant, the company bought a milling facility in 2005 that is currently operating at 320tpd for normal production on a sector of Santa Juana mine.

Despite major discoveries that ECU has been made so far the geological conditions imply the possibility of bigger ones to appear!

Yet in an early stage, drilling program in Santa Juana and San Mateo mines has showed great discoveries with large extensions of average grade of silver above 150 g/t and of gold above 4g/t.

On a very conservative approach, resources were reported (for 2005) at 17.4 million ounces of silver equivalent and inferred resources were 81 million ounces of silver equivalent. In reality and including the discoveries that already took place in 2006, total resources so far should be estimated around 250 million ounces of silver equivalent. And we must remember that ECU has only completed less than 30% of its exploration program.

Without any doubt we have here a top junior mine company which is most probably going to deliver huge returns on the long term.

Our stocks

Dear Gold Portfolio

Buy 1.000 ECU Silver Mining (ECU.V) at 3.15

Buy 1.000 Mundoro Mining (MUN.TO) at 2.00

Buy 200 Aurelian Resources (ARU.V) at 25.5

quinta-feira, outubro 12, 2006

Mundoro Mining

Mundoro Mining Inc. is a Canadian company listed on the TSX (ticker symbol MUN.TO). It is the largest gold project in China to be explored by a Sino-Canadian joint venture and is believed to be one of the largest undeveloped gold deposits in China.

The company has a 79% interest in the Maoling gold deposit, which is located in the Liaoning Province in north-east China, in the old area of Manchuria, not far from Beijing.

As Maoling has measured and indicated resources of 161 million tonnes grading 0.92 grams gold per tonne, it contains 4.8 million gold ounces. Even with such a low grade we arrive at an extraordinary amount of payable gold.

The development team is experienced in working in China and a bankable feasibility study is due in mid-2007 with production projected in the first half of 2009.

The capital cost is estimated at US$235 million and cash costs of US$167/ounce. The company has forecast that at $400-gold, the internal rate of return would be 18% with net present value of 134 million.

With a market capitalisation of approximately US$74 million, Mundoro Mining is probably a very interesting long term investment.

Our stocks

Time to buy junior miners...

Buy 500 Cumberland Resources (CLG) at 4.85

Buy 3.000 Tara Gold (TRGD) at 0.55

Buy 2.000 Bullion River Gold (BLRV) at 0.90

terça-feira, outubro 10, 2006

Wait just a bit more!

Click chart to enlarge

Click chart to enlargeChart courtesy of http://stockcharts.com

Gold and Silver are fighting and I think they are doing very well. Strong, very strong hands, couldn´t manage to dump them and they remain above last major bottoms.

November will be a good time to see precious metals rally. We only have to wait for the elections.

Junior gold and silver companies are waiting to be bought. Tomorrow I may resume trading.

domingo, setembro 24, 2006

A tale of two commodities

Gold is not really a commodity, it has other merits – it is a precious metal and is increasingly seen again as real money, a reserve asset suitable for institutions and individuals.

Therefore, if we want to see what is moving the commodity index (as measured by CRB) we easily find that Oil is the heavy weighted commodity that leads the market. In fact, when we observe the charts the conclusion appears clear as water.

Only one significant doubt remains: Where do we find a short term bottom for Oil?

Click chart to enlarge

Click chart to enlargeChart courtesy of http://stockcharts.com

sexta-feira, setembro 22, 2006

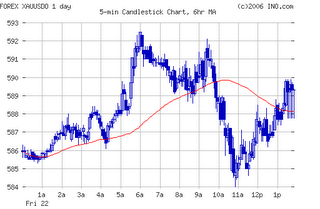

Breaking 590 is hard work!

Have we seen the bottom for now as Gold spot is under 590? I wouldn´t bet on that yet. Nevertheless, we can see some good signs – strong demand, price strength when other commodities are weakening (CRB chart). But only when Gold breaks 590 and then 600 we will be more enthusiastic.

terça-feira, setembro 19, 2006

Our stocks

Dear Gold Portfolio

It is an excellent time to buy junior miners.

Cumberland Resources (CLG) is firmly above 4.80 support all the way during gold sell off. The company is on the final stage of the development of a major gold mine (Meadowbank), Canada’s Largest Pure Gold Open Pit.

ECU Silver Mining (ECU.V) is continuing exploration program of the Santa Juana mine in Mexico with encouraging results so far.

Buy 500 Cumberland Resources (CLG) at 5.70

Buy 500 ECU Silver Mining (ECU.V) at 3.10

domingo, setembro 17, 2006

Sellers beware

Following September 5th false breakout we had a devastating sell off that is likely not done yet. Nevertheless, we are already in a very extending stance for Gold. While not trying to guess bottoms, we must watch carefully any future buy signal.

As Gold continues to show weakness the setup on the daily chart may point to a near bottom. I think downside risk stays around 570/572 level. Though RSI(12) is already under 30 we may see some consolidation followed by a test to the 542 level. If this is to happen and Gold bounce back up then I believe a rally will follow.

Silver has a similar story and though it has a more substantial downside risk, at this juncture it is likely to go along with Gold.

Click chart to enlarge

Click chart to enlargeChart courtesy of http://stockcharts.com

quinta-feira, setembro 14, 2006

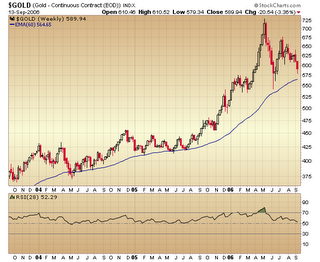

Long term is not so far away!

We are comfortably in a long term bull market for Gold. The weekly chart helps us clarify any doubts. Look at the EMA(60), a real and very strong support the whole time, and the RSI(28) that never tumbled under 50.

There is another issue I´d like to emphasize: very powerful hands are surely trying to push down Gold and supporting the US Dollar until November elections. But Gold market strength is keeping up and it will do much better afterwards.

quarta-feira, setembro 13, 2006

Junior Gold companies (CANARC RESOURCE)

Canarc Resource Corp. (CRCUF: OTC-BB) is a gold exploration and mining company focused on the discovery and development of large gold deposits in North, Central and South America. Its principal assets include the high-grade New Polaris gold mine project in Canada, the large Benzdorp gold exploration property in Suriname and a production royalty on the new Bellavista gold mine in Costa Rica.

New Polaris has a major pre-feasibility program now underway and recent exploration on the Benzdorp property has identified several attractive gold prospect areas for drilling.

Canarc has no financially problems and major shareholders include Barrick Gold and Kinross Gold Corp.

CRCUF price movement make us believe it has great upside potential tough its shares are naturally speculative.

segunda-feira, setembro 11, 2006

“Falling knife”

Click chart to enlarge

Click chart to enlargeChart courtesy of http://stockcharts.com

As the larger and better companies were the most affected it is interesting to observe Newmont Mining chart. The near future is promising…

Our stocks

Dear Gold Portfolio

Gold is dropping and it is not so bad to buy weakness when it is likely to be short-lived.

Buy 300 Ivanhoe Mines (IVN) at 7.05

Buy 1.500 Pacific Rim Mining (PMU) at 0.85

domingo, setembro 10, 2006

Dollar at risk

The US Dollar (USD) is a sort of enigma nowadays. It´s like the USA debt currency but still is a kind of world cash. Anyway, I think a monumental Head and Shoulders top pattern is developing (H - 92.63; S1 – 85.44; S2 – 87.33). Breakdown of potential neckline at 84 targets 72 level. On this outcome, Gold will be climbing fast in parallel. But we have to wait and see if the pattern stands and is really activated.

As a matter of fact if Gold could manage to go up during 2005 with a climbing USD I am curious to see the real upside potential for Gold on the context of a descending USD. On the short term USD is holding and even showing good strength but in my opinion this is not sustainable.

On a possible world crisis, USD is everything but a good option as it surely will fall behind due to recession, lower interest rates and several imbalances.

sexta-feira, setembro 08, 2006

Gold consolidation is not done

Click chart to enlarge

Click chart to enlargeChart courtesy of http://stockcharts.com

Junior Gold companies (IVANHOE MINES)

Click chart to enlarge

Click chart to enlargeChart courtesy of http://stockcharts.com

Ivanhoe Mines (IVN) key asset is the Oyu Tolgoi Project, the world's largest copper-gold development project located in the south Gobi region of Mongolia, 80 km north of the China border. Ivanhoe also controls exploration rights in Mongolia, where additional discoveries of coal, copper and gold are being delineated, and is exploring for gold and copper in Inner Mongolia, China, and Queensland, Australia.

Ivanhoe Mines is a 50%-owner of the Monywa Copper Mine in Myanmar, and has a 70% interest in the Bakyrchik Gold Mine in Kazakhstan.

The Mongolian Government is negotiating with Ivanhoe Mines on a formal agreement that will set a tax, financial and legal 30-year framework for the Oyu Tolgoi copper-gold mining project in the country. Mine life is projected at 40 years with an annual production of 1 billion pounds of copper and 330,000 ounces of gold. Ivanhoe’s negotiation process is also expected to cover whether the Mongolian Government or a future state-owned mining company would exercise an option of up to 34% ownership of the Oyu Tolgoi project. Currently, Ivanhoe owns 100% of the project.

After a huge fall in May with a tremendous gap down (after the approval of a new tax measure, currently under renegotiation), IVN was trading on a deep downtrend with prices under EMA50 and EMA200. But on the beginning of September, despite a weakening Gold, the price is breaking up (closed today at 6.87 on strength) and if it manages to exceed 7.00 and 8.00 resistances, the gap will be certainly closed and price may be headed to revisit 10.57.

Topics worthy of note

Highland Gold blamed by Russian official for mine fire

The exact cause of the fire has yet to be established but according to first reports it was caused by welding works being undertaken in the shaft. An estimated 64 miners were trapped underground at the time. Thirty-one were quickly evacuated to the surface, 12 bodies have been recovered and 21 miners are missing and still being sought by rescue workers at the site. Highland Gold operates both an open pit at the site and an underground mine, but due to inadequate stope development and a shortage of experienced development miners only 11,761 ounces were reported as recovered at the mine in the six months to June 30 (one-third of the company's production target). With a current market capitalization of GB£260 million, Highland's share price hit peak in February of this year at 330 pence and it has been falling since then (started Friday trading in London 8% down approaching 159).

World diamond prices are softening

The International Diamond Exchange (IDEX) reported this week that world diamond prices are softening due to high jewelry industry debt, combined with slowing diamond demand. For the first time in recent history, the price of 1.5 carat and 2-carat polished diamond “fell below the same period a year ago,” according to IDEX. “In short, the diamond price weakness which first affected the smaller stones has now begun to affect larger stone sizes.” Nevertheless, prices of larger solid diamonds - 4 carats and 5 carats in size, which represents an aggregate of about 1% of the market - continue to show solid gains.

Market determination

Click chart to enlarge

Click chart to enlargeChart courtesy of http://stockcharts.com

Among other important aspects, geopolitical problems (which have calmed for now) are a critical factor for gold. And it is a key issue for oil that has been dropping heavily for more than a month in parallel with world troubles softening. This situation sooner or later would hit Gold as it did today (and other markets as well).

In the charts we see oil stretching to the downside, even under EMA200, and Gold back to the 616 zone.

Let´s see what kind of weakness we may still observe on the near future.

quinta-feira, setembro 07, 2006

NORTHGATE MINERALS in brief

Click chart to enlarge

Click chart to enlargeChart courtesy of http://stockcharts.com

Northgate Minerals Corporation (changed the name from Northgate Exploration) is a gold and copper mining company, whose principal assets are the 300,000 ounce per year Kemess South mine in British Columbia, the adjacent Kemess North deposit of 4.1 million ounces of gold and the Young-Davidson property in northern Ontario with a total resource base of 1.5 million ounces of gold. Northgate is listed on the Toronto Stock Exchange and on the AMEX (NXG).

In 2005, Northgate had a net profit of $32,9 million, 5% more than in the previous year.

In the first half of 2006 recorded a net profit of $77,9 million and sales of $199,8 million compared with a loss of $13,8 million and sales of $97 million during the corresponding half of 2005.

Northgate has small and decreasing gold and copper forward sales commitments and its financial structure is sound. The ratio of debt to equity is .276, which is excellent.

Even deducting a $17 million non-cash future income tax recovery included in the net earnings for the second quarter of 2006, we arrive to net earnings per diluted share of $0.173 in that quarter. Assuming that the company performance and the price of gold remain the same (which is very modest) we get a PER of 5,8 for the next twelve months (with the present share price). This is extremely favourable and probably unique for the mining sector.

Northgate shares have been climbing since a minimum of 0.92 (May 2005) and could manage to reach 4.82 just one year later. Then a huge correction followed and after a consistent consolidation the share price is now tying to break the 4.00 level. If it succeeds the price may be headed to new all time highs.

Our stocks

Carteira do Blog

With no cash left I must sell half of my Agnico position in order to buy what I think is a hot stock (at least on the medium term).

Sell 250 Agnico Eagle (AEM) at 38.50

Buy 2.000 Northgate Minerals (NXG) at 4.03

Dear Gold Portfolio

Today I´m going to buy shares of two junior gold miners that are presently on different stages of project development. Shortly, I will publish here a brief analysis of both.

Buy 700 Miramar Mining (MNG) at 4.65

Buy 3.000 Abcourt Mines (ABI.V) at 0.76

quarta-feira, setembro 06, 2006

Oil price fall

Gold and HUI

Click chart to enlarge

Click chart to enlargeChart courtesy of http://stockcharts.com

Gold chart looks good and I believe we are going to see a new intermediate uptrend that could challenge May highs, not a wider range of the consolidation pattern.

And HUI chart looks even better as Gold stocks always take the lead. MACD is giving a fine signal.

terça-feira, setembro 05, 2006

Signs of action

At last we could see some real action on precious metals. Today Gold showed strength when tried to breakout 640 level, which also meant a break to the upside of the triangle formation. But Gold couldn´t have complete success though it was trading above EMA50. All this happened in parallel with a climbing USD which is more signifying.

Silver continues to move well above the 12.60 level broken last week. We have to be patient with Silver because its enormous potential lives side by side with tremendous volatility, which may give some discomfort. But as sentiment remains positive we have to understand that breaking 13.20 today would be surely an almost impossible task.

Dear Gold Portfolio

Following my analysis it´s time to hold some stocks of this junior gold miner. So, today at the open:

Buy 2.500 StrataGold Corp (SGV.TO) at 1.26

segunda-feira, setembro 04, 2006

Junior Gold companies (StrataGold Corp)

StrataGold Corporation (SGV.TO), listed in the Toronto Stock Exchange, is a gold development company focused on advancing two gold projects to production. In 2004, StrataGold acquired two advanced stage gold project, the 1,425 hectare Tassawini property located in Guyana, South America, and the Dublin Gulch and Clear Creek properties in Yukon, Canada.

StrataGold has strong institutional shareholder base, including institutional funds in both North America and Europe, and Newmont Canada (which owns13,4% of the company).

StrataGold has become a public mineral exploration company on November 7, 2003 following an IPO at C$0.40 per share.

Since an intermediate minimum in May of 2005 (C$0.31), its share price climbed to make a top in May at 1.70. Then a huge and healthy correction took prices to just 0.96 (end of August) in what appeared to be a real bottom. Now price action is very strong and have breakout both EMA200 and EMA50 heading to exceed resistance at 1.30.

Gold waiting, Silver running

On a very calm day, Gold is just above 625, a magnet and a safe harbour until real action may return tomorrow.

Silver is feeling free to climb, celebrating Thursday break of an important obstacle. Let´s see if it holds above this level over the coming days.

Topics worthy of note

» Escondida copper mine in Chile is expected to return to normal output levels in a week as workers have returned after 25-day strike. Last year Escondida produced 1.27 million metric tons, around 8% of global copper production. BHP Billiton controls Escondida with a 57.5% stake and Rio Tinto holds 30%.

» Mining company Gold Fields has reaffirmed the company's interest in the platinum sector although the company's core business will remain gold. Stating that the pgm sector could make up as much as 25 per cent of the company's business in the future, Gold Fields has so far centred its pgm interests on Finland and the Bushveld region of South Africa. Despite plans to increase platinum use in the automotive and industrial sectors, sales of platinum jewellery will be the key player in supporting prices over the coming years.

domingo, setembro 03, 2006

The worst month for stocks (S&P500)

Click chart to enlarge

Click chart to enlargeChart courtesy of http://stockcharts.com

One thing is sure: September has proven to be the most difficult month for stocks.

Looking at the S&P500 daily chart we find two options for the near future. If we believe in tricky setups we may accept the inverted Head & Shoulders of May/July (Head at 1219.29 and Shoulders at 1245.34 and 1224.54). Even if it proves to be valid it is no big deal. On the other way, we have a signal given by MACD Histogram which tells us that a bearish divergence is in place as S&P 500 higher highs collide with Histogram lower highs.

I know exactly what you are thinking: things are clear if we keep it simple and just notice that a fine trend line is heading north and on the way of breaking 1311. There is only one problem: markets are everything but simple!...

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-jpy-small.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-chf-small.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-cad-small.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_gold.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_silv.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/sp_en_6.gif)

![[Most Recent HUI from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_hui_en_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/copper-d.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/zinc-d.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/aluminum-d.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/nickel-d.gif)